How to Invest in REITs — And Why You Might Want To

Let’s say you’ve always wanted to invest in real estate. Because who wouldn’t?

It’s tangible. It’s familiar. And your parents probably told you it’s one of the safest bets out there.

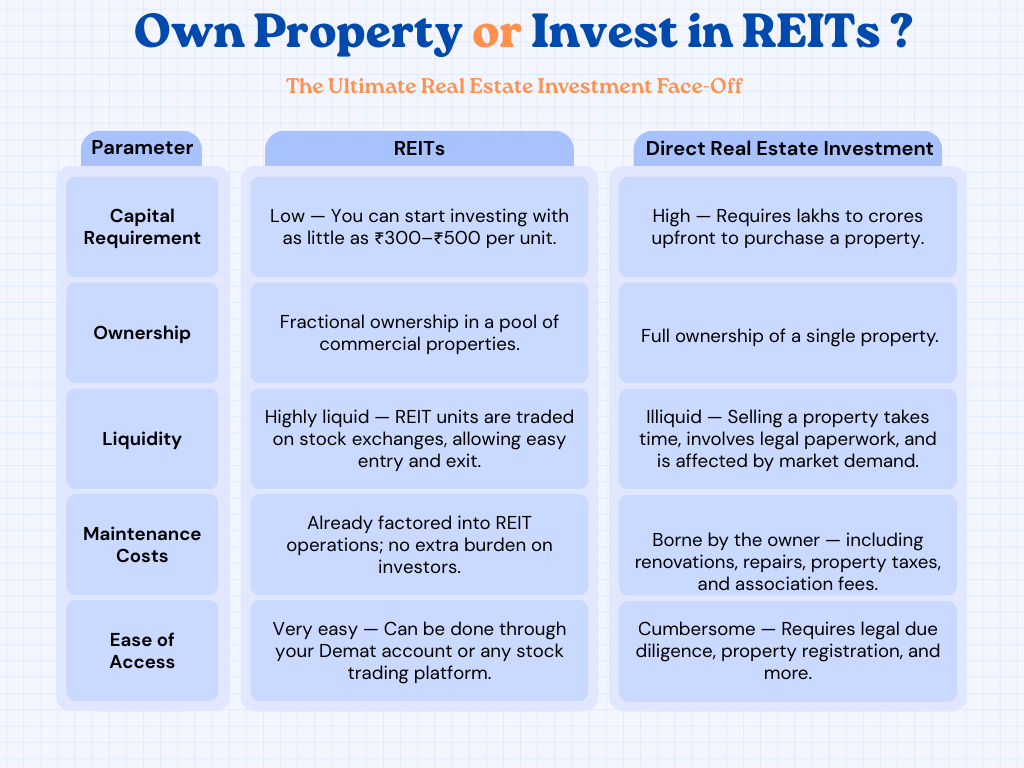

But here’s the thing — buying property in India, especially in a metro city, isn’t easy on the wallet. A 2BHK in Mumbai? That could set you back a crore or more. And even if you somehow manage the down payment, there’s a long list of things to worry about.

Tenant issues. Legal paperwork. Registration. Property tax. Maintenance costs. Unexpected repairs. Broker fees. And let’s not forget the months when your flat might sit vacant.

Suddenly, that “safe” investment doesn’t feel so safe anymore. Now imagine this…

What if you could still invest in premium real estate — say, a high-end office space in Bengaluru or a mall in Hyderabad — without ever having to lift a brick, chase a tenant, or deal with society meetings?

What if you could earn rental income from Grade A commercial properties while sipping coffee at home?

Sounds like a dream, right? That’s exactly what REITs offer.

🧠 Did You Know?

REITs are mandated to invest at least 80% of their assets in completed and income-generating properties.

1. First off, what’s a REIT?

Let’s break it down.

You’ve probably heard of mutual funds — those investment vehicles where a fund manager pools money from a lot of people and then uses that money to buy stocks or bonds. It gives you a piece of the action without having to buy individual shares yourself.

Now, imagine the same thing… but instead of stocks, the pooled money is used to buy real estate.

That’s what a REIT — or Real Estate Investment Trust — is. A REIT is a company that owns, operates, or finances income-generating real estate. These could be massive office complexes leased out to big IT companies, retail malls buzzing with weekend shoppers, industrial parks, data centers, warehouses, or even hospitals.

Let’s take a real-world example.

Suppose there’s a REIT that owns multiple office buildings leased to MNCs like Google, Accenture, or Deloitte. These companies pay rent every month. The REIT collects that rent, uses a portion for maintenance and admin costs, and then passes on the remaining income to investors.

You don’t have to deal with tenants. You don’t have to worry about repairs. And you certainly don’t need to spend crores buying commercial real estate.

Yet, you earn a steady stream of passive income. All by holding units of the REIT in your Demat account.

Here’s where it gets interesting.

These properties generate rental income. And REITs are legally required to distribute at least 90% of that income back to shareholders — you and me — in the form of dividends. But it’s not just about income.

REITs can also appreciate in value — just like property. If the demand for premium commercial real estate goes up, or if rental yields improve, the value of your REIT units might rise too.

So, you’re getting income + potential capital gains — that’s two birds with one stone. So yes, you earn rent without being a landlord.

2. But How Do You Actually Start Investing in REITs in India?

Okay, so REITs sound great in theory.

You get real estate exposure. You earn passive income. And you don’t have to chase tenants or fix leaking taps.

But here’s the next big question — how do you actually invest in one?

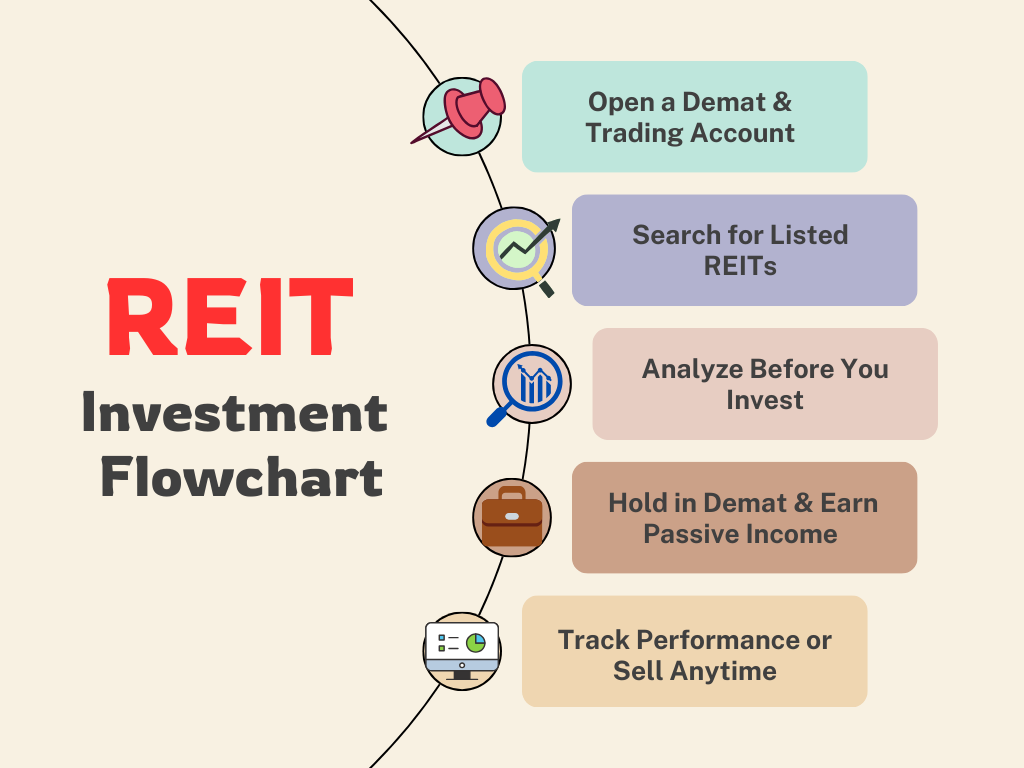

Well, here’s the good news — it’s almost as easy as buying a stock.

No property visits. No stamp duty. No paperwork marathons. Just a few taps on your phone.

Step 1: Open a Demat Account

This is your entry ticket.

If you’ve ever bought shares of a company like TCS or Infosys, you already know the drill. You need a Demat account — a digital locker that holds your securities — and a trading account to buy or sell them.

If you already have these accounts with platforms like Zerodha, Groww, Upstox, or Angel One — great! You’re good to go.

If not, it takes less than 15 minutes to set one up today. PAN card, Aadhaar, and a quick selfie. That’s it.

Step 2: Search for Listed REITs in India

Now, this is where things get interesting.

India’s REIT market is still in its early days, but we’ve already got a few strong players on the stock exchange. Each of them focuses on different types of commercial properties:

- Embassy Office Parks REIT — The first REIT in India. Owns a portfolio of premium office spaces leased to companies like IBM and Google.

- Mindspace Business Parks REIT — Think large IT parks across Mumbai, Pune, Hyderabad, and Chennai.

- Brookfield India REIT — A global name with a focus on Grade A office properties in major Indian cities.

- Nexus Select Trust — India’s first retail-focused REIT, owning some of the most popular shopping malls across the country.

And yes — all of these REITs are listed on NSE and BSE, just like regular stocks.

| REIT Name | Market Cap (Approx.) | Focus Areas | Key Properties | Occupancy Rate | Dividend Yield (2024) | Launch Year | Unique Proposition |

|---|---|---|---|---|---|---|---|

| Embassy Office Parks REIT | ₹36,000 Cr+ | Premium office parks in Bengaluru, Pune, Mumbai, and NCR | Embassy Manyata Tech Park, Embassy TechZone | ~86% | 6.5% | 2019 | India’s first REIT; strong presence in IT hubs |

| Mindspace Business Parks REIT | ₹22,000 Cr+ | Grade A IT Parks & SEZs in Mumbai, Pune, Hyderabad, Chennai | Mindspace Airoli West, Mindspace Madhapur | ~85% | 6.2% | 2020 | Diversified across west & south India IT corridors |

| Brookfield India REIT | ₹9,500 Cr+ | Office properties in Noida, Gurugram, Mumbai, and Kolkata | Candor Techspace, Equinox Business Park | ~80% | 6.0% | 2021 | Backed by Canadian giant Brookfield; focuses on metro cities |

| Nexus Select Trust REIT | ₹17,500 Cr+ | Retail malls and urban consumption centers across 14 cities | Select Citywalk Delhi, Nexus Elante Chandigarh, Nexus Seawoods Mumbai | ~93% (Retail) | 5.8% | 2023 | India’s first retail-focused REIT with pan-India mall network |

🧠 Did You Know?

India’s first REIT — Embassy Office Parks — was listed in 2019, making it a relatively new investment option in the country.

3. Are There Risks Involved?

Of course, there are. Every investment comes with its share of risks. And REITs, while more stable than the average stock, are no exception.

They look safe because they’re backed by real estate — solid buildings, big tenants, and long-term leases. But beneath the surface, a few things can shake up your returns.

Let’s unpack that.

The Interest Rate Effect

One of the biggest risks with REITs is how they respond to interest rate movements.

REITs are income-generating assets. Most people invest in them because they want a steady stream of dividends, like they would from a fixed deposit or a bond.

But when interest rates in the broader economy start rising — say, the RBI hikes repo rates — investors start looking elsewhere. Suddenly, government bonds and fixed deposits become more attractive because they’re offering similar returns with lower risk.

And that’s when REITs take a hit.

Their prices often fall when interest rates go up, because the relative appeal of their dividend income goes down.

So while it may not be immediate or dramatic, REITs are sensitive to the interest rate environment. Especially in times of monetary tightening.

Market Volatility

Then there’s the issue of market sentiment.

REITs are listed on stock exchanges. Which means their unit prices are subject to daily market volatility.

Even if the underlying real estate is performing well — say the office buildings are 90% occupied and the rents are steady — the price of the REIT units might still drop. Why?

Because markets move on sentiment, news cycles, and sometimes even social media hype.

A global recession scare. A poor earnings report from a big tenant. A sudden rise in COVID cases. Any of these could spook investors and drag down REIT prices.

So yes, REITs give you real estate exposure, but they still move like stocks — especially in the short term.

Property-Specific Risks

Here’s something that’s often overlooked.

REITs invest in physical properties — buildings that need to be maintained, occupied, and kept in demand. And anything that affects these buildings or their tenants can directly hit your returns.

Let’s say one of the REITs you invest in owns a commercial tower in a business district.

Now imagine a situation where

A large tenant (like a tech company) vacates half the building.

OR

A new work-from-home trend reduces demand for office space.

OR

There’s a sudden oversupply of commercial real estate in that area.

In any of these scenarios, the REIT’s rental income will fall. And since most of your returns come from that income, you’ll feel the pinch too.

REITs depend on occupancy rates, tenant quality, and lease structures. If those falter, so does your dividend.

Regulatory & Structural Risks

There’s also a layer of regulatory risk that comes with REITs.

While India’s REITs are regulated by SEBI, and follow globally accepted norms, real estate is still a complex and evolving sector.

Changes in tax laws, land policies, stamp duty rules, or even SEBI’s listing requirements can impact how REITs operate and how much they distribute to investors.

And because REITs are still relatively new in India (the first one listed only in 2019), some of the regulatory framework is still maturing.

So while you’re not flying blind, it’s a good idea to keep an eye on policy updates and structural shifts in the real estate investment ecosystem.

💡 You might find this helpful: First Time Home Buyer Guide

4. So, Are reit stocks in India Risky?

Not in a “highly speculative” way like crypto or penny stocks. But they’re not risk-free either.

They offer stability with some volatility, and income with some unpredictability.

You won’t lose sleep over them in most cases, but it’s important to understand what you’re buying into.

REITs are great for diversification, for passive income, and for long-term exposure to commercial real estate.

But like any smart investor, know the fine print before jumping in.

5. So… Should you invest?

If you’re looking for:

- Regular income

- Diversification beyond stocks and bonds

- Exposure to real estate without the headaches

💡Quick Tip

Don’t invest because it sounds cool. Do it because it fits your financial goals. Then REITs are worth considering — especially as part of a long-term portfolio.

2 Comments