First Time Home Buyer Guide: Your Roadmap to Owning a House

Picture this — you’re curled up on your couch, the aroma of fresh paint still lingering, as you watch the city lights twinkle from your own living room. Feels like a dream come true, doesn’t it?

Buying your first house is a huge milestone. It’s exciting, emotional, and yes… a little terrifying too. After all, it’s not every day you decide to invest lakhs (or crores) of rupees into one decision.

If you’re wondering where to start, you’re in the right place. Let’s decode the First Time Home Buyer Guide for India — step by step — without the confusing jargon.

🧠 Did You Know?

Q4 2024 recorded 72,930 residential property sales, with Bengaluru, Mumbai, and Pune accounting for 64% of the total .

Ask Yourself — “Am I Ready To Buy a House?”

Buying a home isn’t just a financial decision. It’s an emotional one too. It’s the dream of stepping into a space you can call your own. A place where every corner holds your memories, where the walls witness your celebrations and your quiet moments alike. But before you dive headfirst into house-hunting, it’s important to pause and ask yourself — am I truly ready for this?

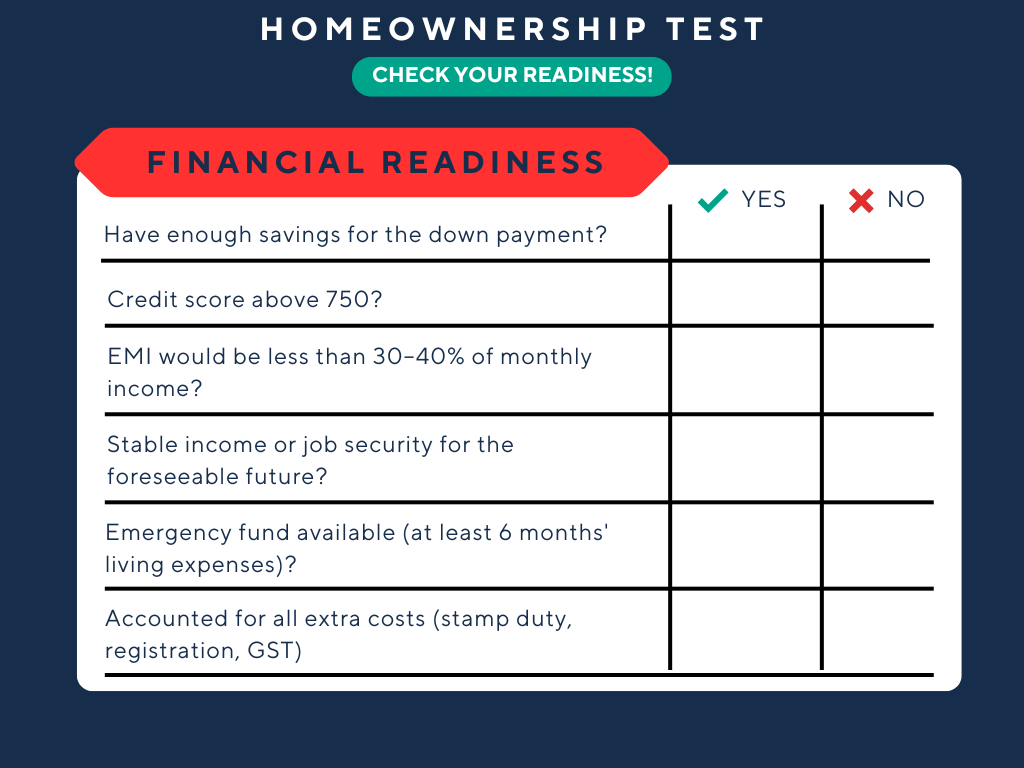

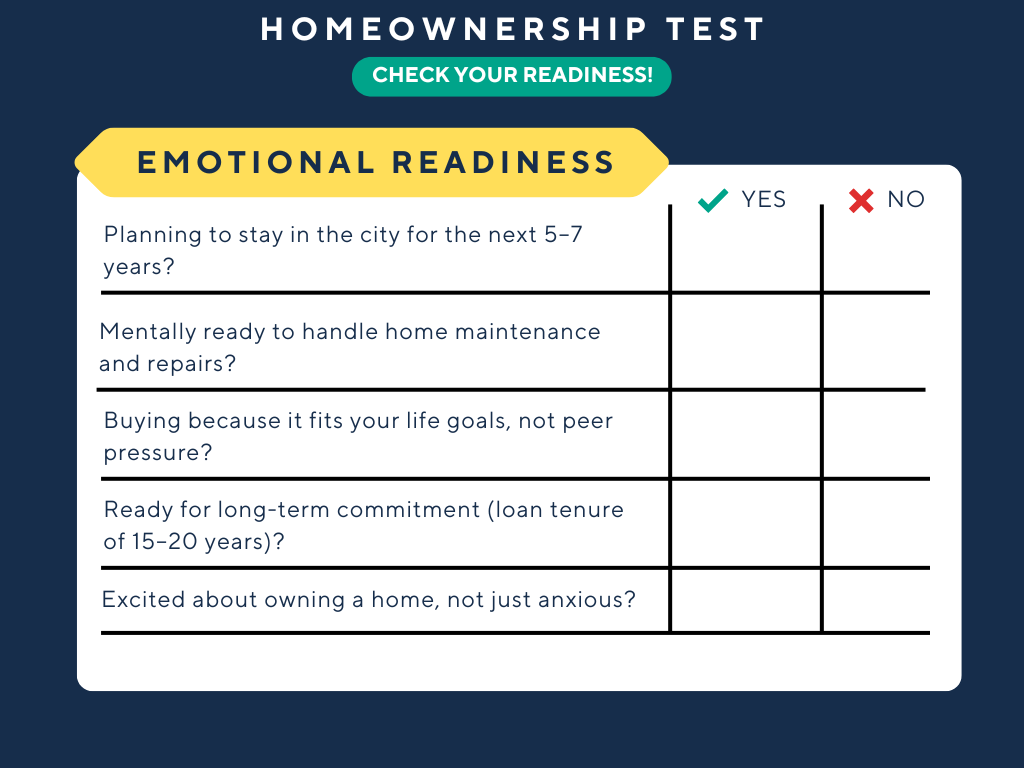

Financially, buying a home means much more than just affording the monthly EMI. You need to have savings ready for the down payment, which is typically 10–20% of the property cost. Then there are stamp duty, registration charges, interior costs, and a dozen other small but significant expenses that can catch you off-guard if you’re not prepared. If you’re living paycheck to paycheck, or still paying off heavy loans, it might be wiser to wait a little longer.

Emotionally too, owning a home demands stability. Are you planning to stay in the same city for the next few years? Is your career relatively stable? Are you ready to take on the responsibilities that come with homeownership — maintenance, society meetings, unexpected repairs? These are important questions that deserve honest answers.

Sometimes, renting a little longer and building a stronger financial cushion can be the smartest move. It’s not about rushing because everyone else seems to be buying. It’s about knowing when you are ready — not just in your wallet, but in your heart.

Setting a Realistic Budget

Now comes the real question — how much can you actually afford?

We all dream of owning a 3BHK in Mumbai or a villa in Goa, but dreams and budgets often live on different planets. And that’s okay. What matters is setting a budget that won’t keep you awake at night worrying about EMIs.

Banks usually offer loans where the EMI doesn’t exceed 40% of your monthly income. So, if you earn ₹1 lakh a month, ideally, your EMI should stay around ₹40,000. It’s a thumb rule meant to ensure you still have enough left over for groceries, school fees, Netflix subscriptions, and the occasional Goa trip (even if you don’t own a villa there yet).

But what if your budget doesn’t allow you to purchase a property yet? Don’t worry, you can still get involved in real estate investment through REITs (Real Estate Investment Trusts). You can explore more about REITs and how they can be a great option for new investors here.

💡Quick Tip

If you’re unsure about how much you can afford, consider consulting a financial advisor who can give you a personalized assessment based on your income, assets, and goals.

Location, Location, Location

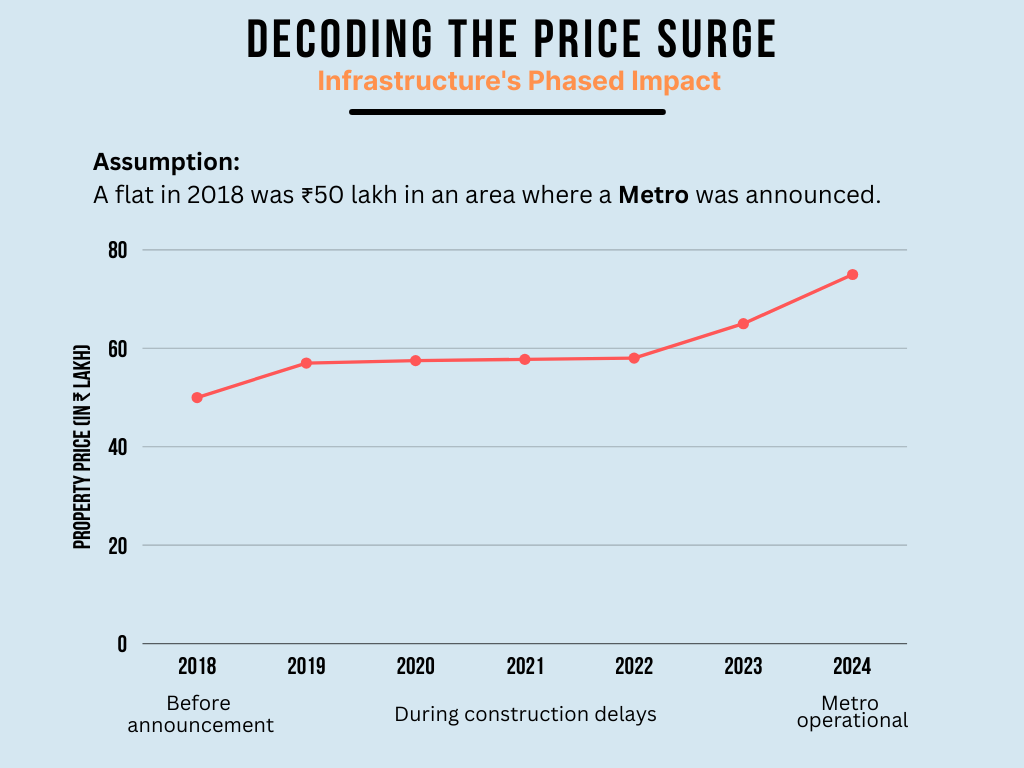

They say you can change almost everything about a house — paint the walls, redo the floors, even add an extra room. But what you can’t change is where it stands.

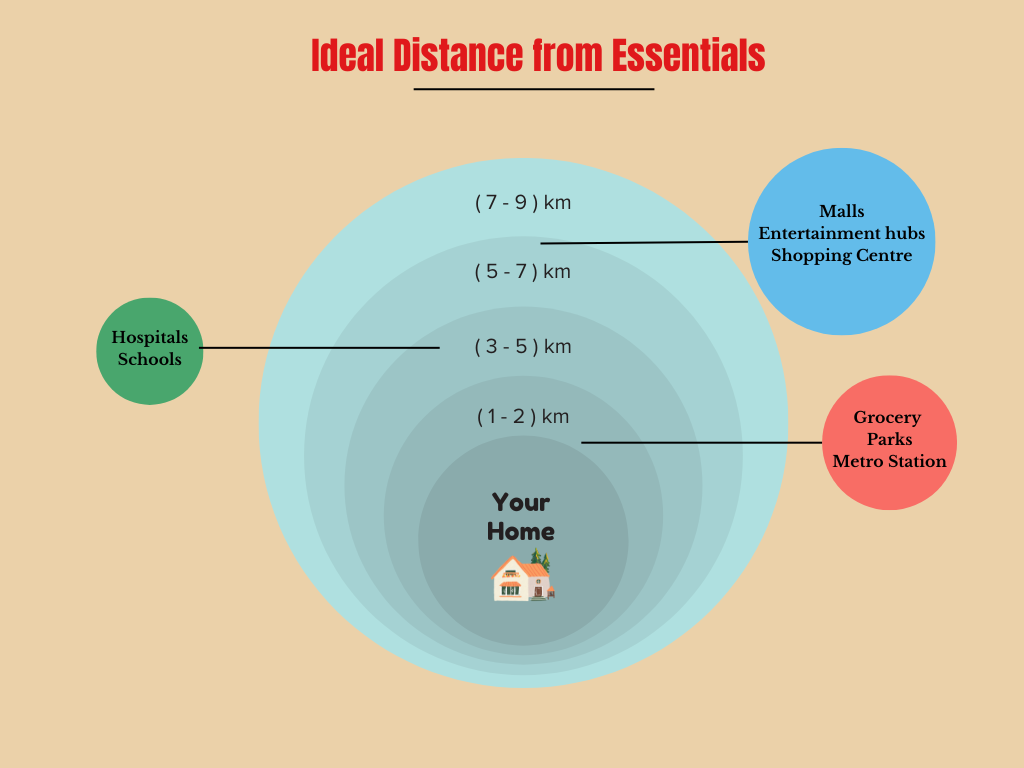

Location is the soul of your home, not just a pin on the map. It decides how you live, how much you commute, what school your kids go to, and even how your property grows in value over time. It’s not just about being close to the office or metro station, although those are important. It’s about asking yourself — “Will I still love living here five or ten years down the line?”

Start by thinking about your lifestyle. If you’re someone who hates long commutes, maybe paying a premium for a central location makes sense. If you’re dreaming of quieter weekends and cleaner air, a slightly farther suburb could be perfect. Some people fall for the charm of emerging areas because they are affordable today and might become the next big thing tomorrow. But be careful — not every “upcoming hotspot” actually comes up.

Then there’s the social side of it. Check if essential things like hospitals, schools, supermarkets, and parks are easily accessible. Nobody likes driving 20 kilometers just to grab milk at 10 PM.

Choosing the right location is a mix of head and heart. It’s about finding a place that matches not just your budget, but your dreams and your daily reality.

New Construction vs Resale: What Should You Pick as First Time Home Buyer?

One of the first decisions you’ll face as a homebuyer is whether to go for a brand-new property or a resale one.

New construction has its charm — everything is fresh, untouched, and customizable. You might even get modern amenities like clubhouses, swimming pools, and fancy lobbies. But patience is key. Even if the builder promises quick possession, delays are common. Plus, you might have to juggle paying rent and EMI together for a while.

Resale homes, on the other hand, offer certainty. You can physically see the house, assess the surroundings, and move in almost immediately. Older properties are often in established areas with working infrastructure — no waiting for malls or metro stations to come up. However, you might have to spend a little extra on repairs or renovations.

In the end, it’s about what suits you. If you can wait and want the thrill of everything new, under-construction could work. If you value certainty and ready-to-move convenience, resale could be the smarter choice.

💡Quick Tip

When considering new construction, always look into the builder’s track record. Research customer reviews and project completion history. Don’t just rely on promises — check for previous delays.

Cracking the Home Loan Process

Mostly first time home buyer in India rely on home loans to fund their purchase.

That’s why picking the right loan matters a lot. Start by checking your home loan eligibility, which depends on your income, CIBIL score, and existing debts. Then choose between a floating interest rate, which can change over time, or a fixed interest rate, which stays constant throughout your loan tenure.

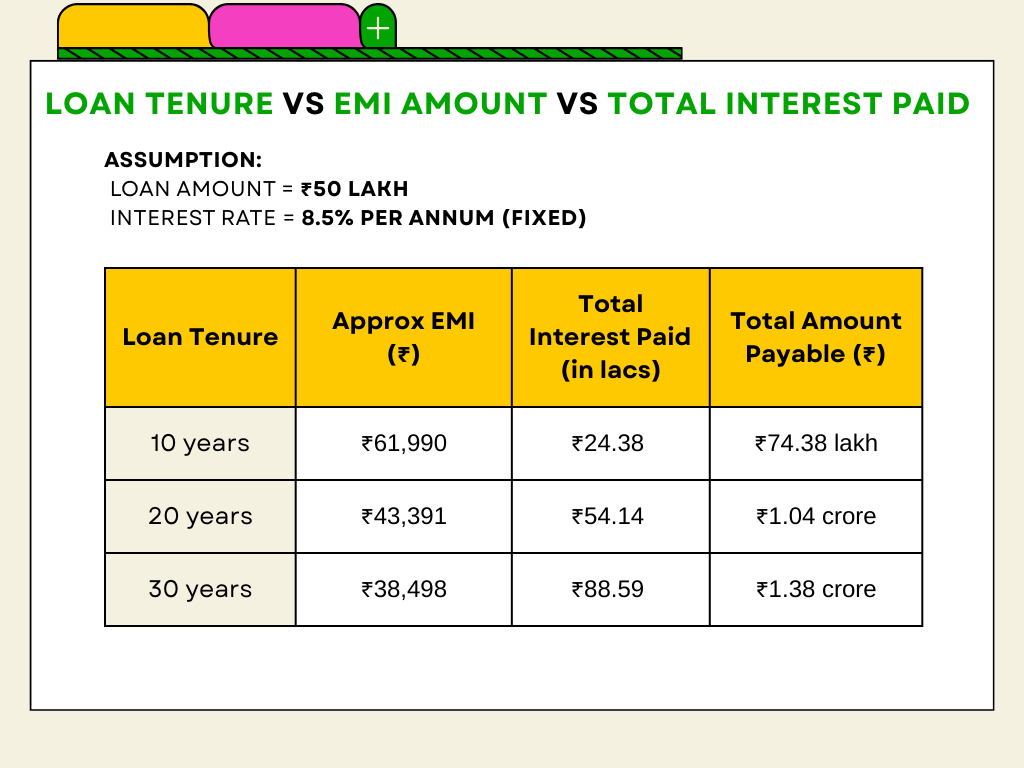

Decide on the loan tenure carefully. A longer tenure means lower EMI but more total interest paid over time. Also, check if your bank allows prepayment without penalties, because paying off your loan early can save lakhs. If you are eligible for the government’s PMAY subsidy, you could save up to ₹2.67 lakh — a fantastic bonus if you qualify.

You can easily find online home loan EMI calculators that help you simulate different loan amounts, interest rates, and tenures. Play around with these numbers. Check how a 20-year loan feels versus a 30-year loan. See how a slight rise in interest rate affects your EMI. It’s better to discover these surprises on a screen than in real life.

Double-Checking the Legal Work

Legal verification might sound boring, but skipping it could be the costliest mistake of your life.

Always check if the property has a clear Title Deed, ensuring the seller legally owns it. Look for an Encumbrance Certificate to make sure there are no unpaid dues or mortgages. If it’s a ready-to-move property, make sure you get the Occupancy Certificate (OC), confirming that the building is safe and approved for living. For new constructions, checking the RERA Registration Number is a must.

💡Quick Tip

A good property lawyer may cost a few thousand rupees, but it’s a small price to pay for peace of mind when you’re investing lakhs.

The Power of Negotiation

Once you like a property, don’t hesitate to negotiate.

Builders and sellers expect it. You can bargain not just on the price but also ask for perks like free parking, waivers on maintenance charges for the first year, or modular kitchen fittings included in the deal. Builders especially are more flexible during the end of the quarter or financial year, when they’re chasing sales targets.

Negotiation tips like how to negotiate property price and tips to negotiate with builder could save you big money.

Final Thoughts

Buying your first home in India isn’t rocket science. It’s a series of simple but important decisions — done thoughtfully. The biggest mistake you can make? Getting carried away by emotions without doing your homework.

So stay calm. Stay rational. And one day, you’ll be sitting on that dream balcony, sipping chai, smiling at how smart you were.

6 Comments