Real Estate Sector in India 2025: Trends, Growth & Challenges

Every Indian family has that one uncle, the guy who swears by real estate sector in India. He’ll forward you a brochure on WhatsApp with glossy towers and say, “Beta (Son), this area is the next Gurgaon. Buy now or regret later.” And honestly? He might not be entirely wrong.

Because if you’ve watched how Indian cities grow, you’ll notice a pattern. First comes a new metro line or highway announcement. Then the builders show up. Property prices start inching up. Offices pop up, followed by schools, cafés, hospitals… and just like that, a quiet patch of land turns into a buzzing suburb.

This domino effect has defined the real estate market in India and top real estate companies in India for decades.

But here’s the real question, does it still work today? With remote work, economic shifts, changing lifestyles, and new rules reshaping the real estate sector in India, is buying property still the safe bet our uncles believe it is?

Let’s break it down.

1. The Big Picture: Real Estate’s Role in India’s Economy

The real estate sector in India isn’t just about buying and selling homes. It’s a significant pillar of the economy. As of 2022, it contributed 7.3% to India’s GDP, with projections suggesting it could reach 15.5% by 2047. That’s a substantial leap, indicating the sector’s growing importance.

The industry has benefited from investor-friendly policies, increased transparency, and a wave of regulatory measures. Key initiatives like the Real Estate Regulation and Development Act (RERA), updated real estate investment trust (REIT) guidelines, amendments to the Benami Transactions (Prohibition) Act, and the introduction of the Goods and Services Tax (GST) have played a crucial role in attracting both global and domestic investments.

Moreover, the real estate market size in India is expected to touch USD 1 trillion by 2030, up from USD 650 billion in 2020. This growth isn’t just numbers on paper; it’s about jobs, infrastructure, and the dreams of millions.

2. Types of Real Estate: More Than Just Homes

Residential Real Estate

When most people think of real estate, they usually picture home, be it a high-rise apartment in the city, an independent villa in a quieter neighborhood, or even a small plot waiting for a dream home to be built. Residential real estate is, without a doubt, the most familiar segment in the real estate market in India, and it continues to grow steadily.

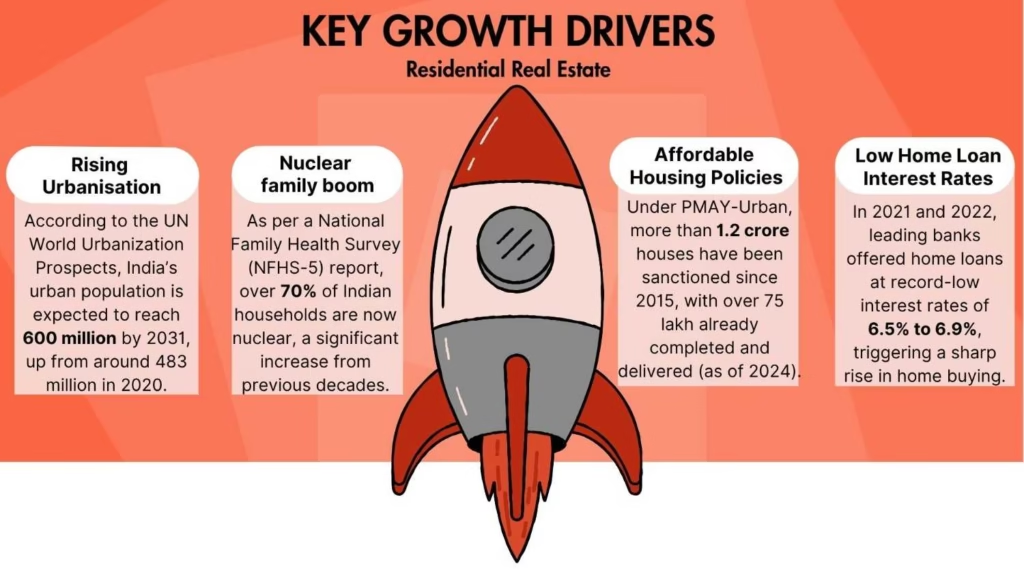

One of the biggest reasons for this growth is simple: India is urbanising at a rapid pace. More people are moving to cities in search of better jobs, education, and lifestyle. And naturally, when people move, they need a place to stay. That’s one key factor pushing the demand for homes.

Another interesting trend is the rise of nuclear families. Unlike earlier times when multiple generations lived under one roof, today’s younger generation often prefers living independently. As a result, more households are being created, and every new household needs its own space. That means more homes, more demand.

Government policies have played a role too. Schemes like the Pradhan Mantri Awas Yojana (PMAY) made home ownership more accessible, especially for middle and lower-income groups. Developers, in turn, began focusing more on affordable housing projects.

And while interest rates have fluctuated over time, the past few years saw historically low home loan rates. That acted like fuel on the fire, encouraging many people, especially first-time buyers, to finally take the plunge and buy a house. Because when EMIs become cheaper than rent, owning a home starts to look like a smarter option.

Commercial Real Estate

This includes office spaces, retail showrooms, shopping malls, and co-working hubs. While residential housing caters to where people live, commercial real estate fuels where people work and shop.

In India, the growth of commercial spaces has mirrored the boom in the service sector. As more companies set up operations, whether it’s IT giants in Bengaluru or retail brands entering malls in Noida, the need for office and retail space has exploded.

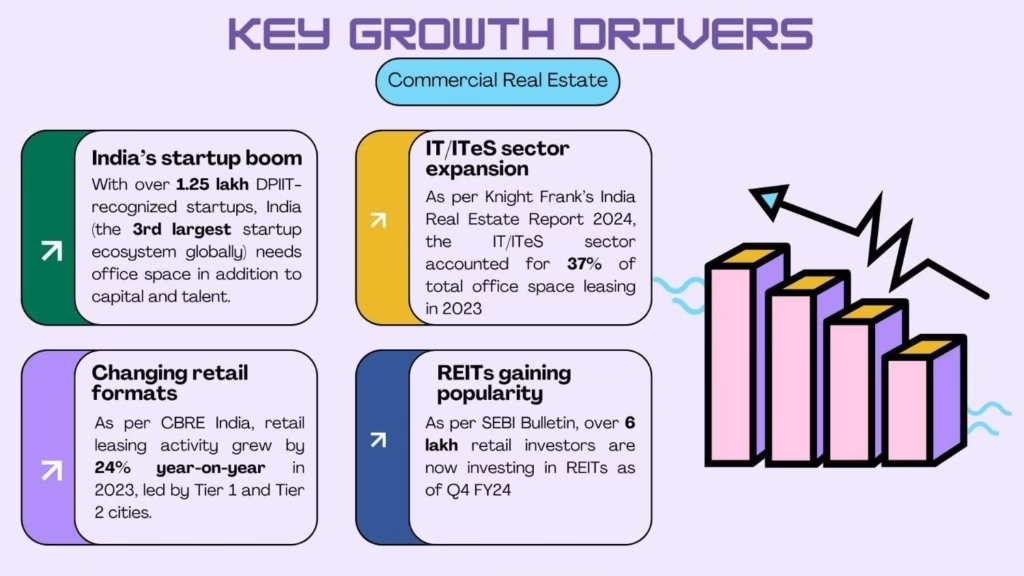

One major factor has been the country’s IT and startup boom. With India now home to over 1 lakh startups and over 100 unicorns (as per DPIIT), every new office set up creates demand for commercial real estate.

And it’s not just startups. Global firms have doubled down on India as an outsourcing and back-office hub. As per CBRE India, office leasing activity hit 61.6 million sq. ft. in 2023, the second-highest on record.

Then there’s retail. With a growing middle class, increasing consumer spending, and the rise of Tier-2 and Tier-3 cities, the retail real estate market is thriving. Retail leasing saw a 24% YoY growth in 2023, according to Knight Frank India.

Industrial Real Estate

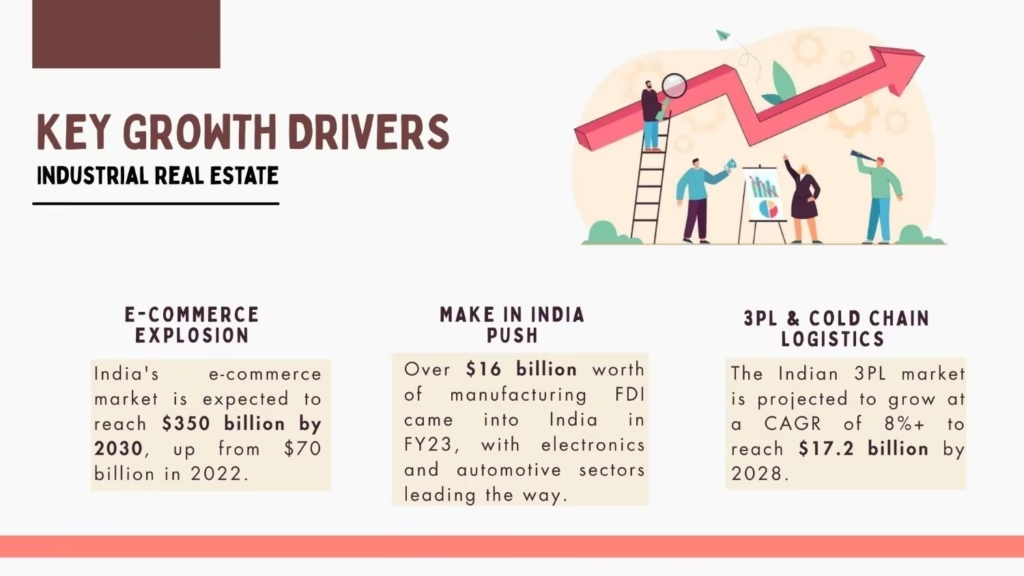

This is the less glamorous, but incredibly essential side of the sector. Think warehouses, logistics parks, factories, and cold storage units. What’s been driving this space? In one word, ecommerce.

With companies like Amazon, Flipkart, and Blinkit promising same-day or next-day delivery, there’s a massive push for robust logistics infrastructure. This means large warehouses on the outskirts of cities, strategically placed distribution centers, and tech-integrated facilities.

In fact, India’s warehousing market doubled in size in just four years, from 35 million sq. ft. in 2018 to over 70 million sq. ft. in 2023, according to JLL India.

Another catalyst has been the Make in India initiative. As manufacturing grows in sectors like electronics, automobiles, and pharma, the demand for industrial land and ready-to-use facilities is seeing a sharp uptick. States like Tamil Nadu, Maharashtra, and Gujarat are becoming magnets for industrial parks and logistics hubs.

Land (Plotted Development)

This is perhaps the most versatile of them all. Undeveloped or raw land can be turned into anything, homes, factories, malls, or even farmland. It’s the blank canvas of real estate.

One major trend in recent years has been the rise of plotted development, especially in the outskirts of metros and in emerging cities. Why? Because many buyers feel owning a piece of land gives them more freedom, lower maintenance costs, and potentially higher long-term returns.

With infrastructure projects like the Delhi-Mumbai Expressway, Atal Setu in Navi Mumbai, and Dholera SIR in Gujarat, land prices in surrounding regions have seen a steady climb. For instance, in Dholera, some land parcels have appreciated by over 30–40% in 5 years, according to local brokers and developers.

Also, land investments often attract NRIs and investors who want tangible, long-term assets that aren’t affected by rental yields or tenant issues.

3. Technology and Sustainability: The New Frontiers in Indian Real Estate

Let’s talk about the greener side of the story.

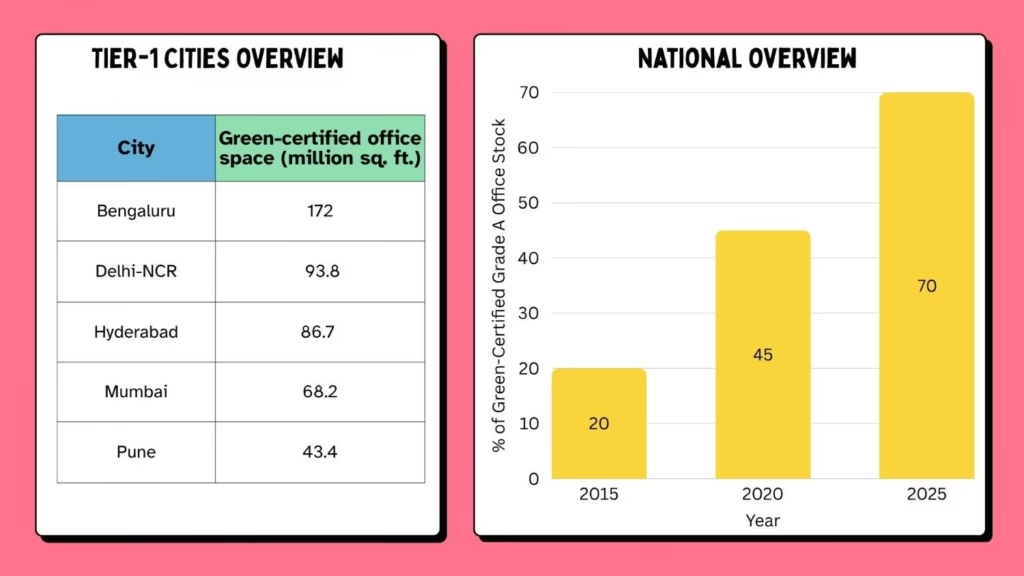

The real estate sector in India is one of the largest contributors to carbon emissions, and developers are waking up to this fact. Green buildings, ones that use less water, optimize energy usage, and improve indoor air quality, are quickly becoming the norm rather than the exception. Not only do these buildings reduce energy bills, but they also attract ESG-focused investors, the kind of investors who care about profits and the planet.

Developers are realizing that going green is no longer just good PR. It makes economic sense too.

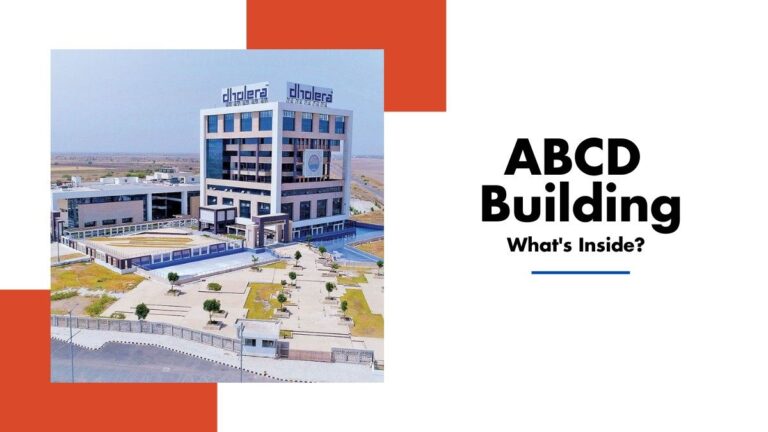

Take Dholera in Gujarat for instance, a city that’s being built from scratch as India’s first planned smart city under the Delhi-Mumbai Industrial Corridor (DMIC). It’s a living example of how technology and sustainability are being woven into urban infrastructure. With 100% underground utilities, centralized command systems, solar power zones, and integrated transport, Dholera is not just aiming to be liveable, it’s aiming to be future-proof. It’s proof that the future of real estate in India isn’t just about location anymore, it’s about innovation.

🧠 Did You Know?

India ranks third globally in terms of LEED-certified green buildings, right after the US and China. That’s over 1,400 LEED-certified buildings, covering more than 2 billion square feet of green real estate!

4. Investment Trends in Real Estate Market in India

5. Future of Real Estate Sector in India: What’s on the Horizon?

The Rise of Smart Cities

India’s real estate future is being shaped not just by concrete and steel but by code and sensors too. The Smart Cities Mission, launched by the government, aims to transform urban spaces into tech-driven, efficient living hubs. What does that mean for real estate?

Think better roads, public transport, energy-efficient buildings, digital governance, and planned infrastructure, all of which drive up real estate demand and value. For instance, Dholera in Gujarat, one of India’s first planned smart cities, is already attracting investments for residential and commercial projects. Developers see it as the next big thing, a blank canvas with all the right policies in place.

Another example? Amaravati in Andhra Pradesh, a city envisioned to become the state’s administrative capital, though slowed by political shifts, still holds long-term potential due to planned infrastructure.

PropTech is Redefining Real Estate

Buying property used to be painful. But PropTech is changing the game, from virtual 3D tours and online payments to blockchain-based land records and AI-powered property search.

Builders are also turning to smart homes, think IoT lighting, voice assistants, and app-controlled access, as a new USP.

The Roadblocks

Of course, challenges remain-outdated regulations, land acquisition hurdles, and shortage of skilled labour. But with reforms like RERA, the sector is becoming more transparent and investor-friendly.

6. Conclusion

India’s real estate sector is stepping into a new era of growth and innovation. With smart cities, sustainable developments, and tech-driven solutions reshaping the landscape, the opportunities are bigger than ever. For investors, homebuyers, and developers alike, this is just the beginning of a promising journey.

One Comment