GIFT City: How Gujarat Is Building India’s Singapore

What Is GIFT City and Why Everyone’s Talking About It

You know how, as kids, we all dreamt of visiting Singapore? That shiny, spotless city with futuristic buildings, fast trains, and that one iconic skyline we saw on TV? It wasn’t just a city, it was a symbol of progress. A place where everything seemed organized, efficient, and somehow light years ahead of what we saw around us.

And maybe, somewhere deep down, we wished India could have something like that too.

A city that feels global, looks modern, and actually works like the ones we admired in travel shows and postcards. Well, what if I told you that dream isn’t so far anymore?

Because between Ahmedabad and Gandhinagar, India is quietly building its own version of Singapore. A financial and technology hub meant to bring the world’s money, ideas, and talent back home.

Welcome to GIFT City (Gujarat International Finance Tec-City): India’s bold attempt to create a global financial hub on its own soil.

The Dream: Building India’s Singapore

Back in 2007, when then Chief Minister Narendra Modi announced the idea of a world-class financial hub in Gujarat, most people thought it was… well, ambitious. The vision? To make GIFT City India’s answer to Dubai International Financial Centre or Singapore’s Marina Bay.

Imagine a place where global banks could freely trade in dollars and euros without hopping across borders. A place where Indian companies could raise money just like they do in New York or London without the endless paperwork or red tape. And a place where financial services could finally operate on a level playing field with the rest of the world.

That was the dream. A clean slate. A world-class financial hub on Indian soil that could compete with the best, not by copying them, but by creating something uniquely Indian, yet globally relevant.

And because India’s traditional financial centres (like Mumbai) were bogged down by regulations, GIFT City offered something new, a sandbox of freedom.

To make this happen, the government created IFSC GIFT City (International Financial Services Centre), where special laws apply. Think of it as “offshore finance within India.”

What Makes GIFT City Different?

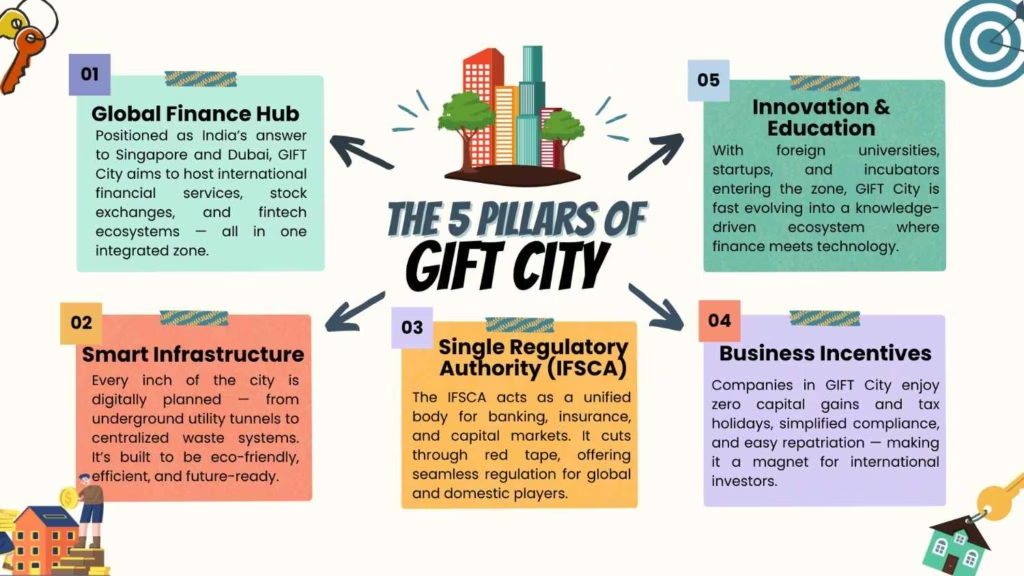

If you walk into GIFT City, it feels like a different world, wide roads, glass towers, and digital infrastructure that actually works. But beyond the visuals, here’s what sets it apart:

If you think about it, GIFT City isn’t just another government project. It’s India’s experiment in building a city of the future. A place where finance, tech, and policy finally speak the same language. Sure, it’s still early days, and there’s a long road ahead before it truly competes with Singapore or Dubai. But if India can pull this off, a city that runs on innovation instead of red tape, then GIFT City might just be the blueprint for how modern India does business.

So, Is GIFT City Working as Planned?

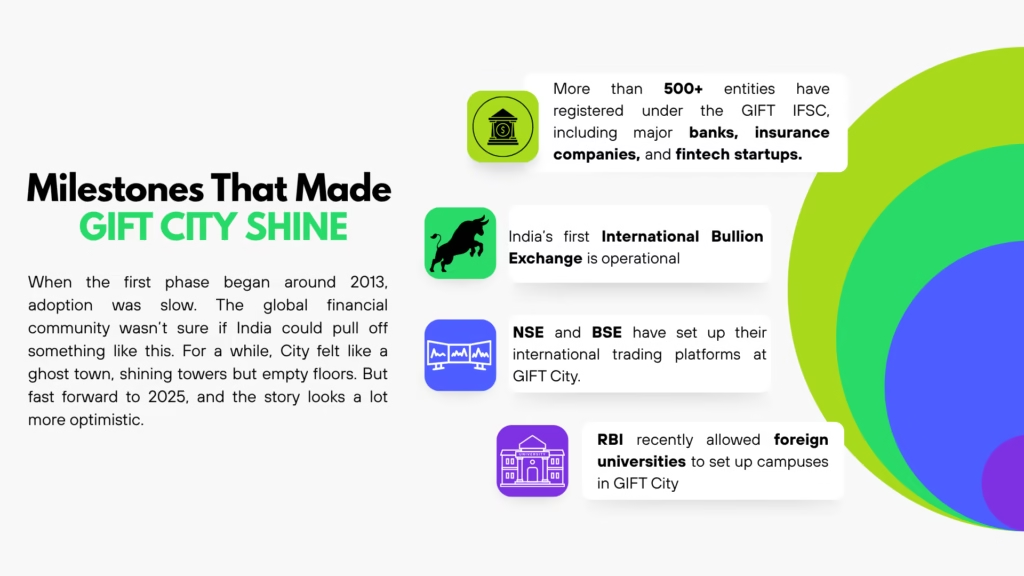

The idea is visionary, no doubt. But execution? A mixed bag so far.

🧠 Did You Know?

GIFT City uses district cooling, automated waste collection, and smart water systems, making it one of the most sustainable urban projects in India.

Why Real Estate Investors Are Excited

Now, let’s talk about what most of us think when we hear “new city”- property prices. In 2018, land rates in City were modest, around ₹3,000–₹4,000 per sq. ft. By 2025, prices in some zones have more than doubled.

Why? Because this city isn’t just offices anymore, it’s becoming a live-work-play ecosystem with residential towers, retail zones, and upcoming metro connectivity. If you’re a long-term investor, this is where the concept of “patience pays” applies.

Think about it: every major financial district, from London’s Canary Wharf to Dubai’s DIFC, took a decade or more to mature. GIFT City is just entering its growth phase. And unlike speculative projects, this one has solid government backing and real infrastructure to show for it.

So yes, it’s not a “flip in 2 years” kind of investment, but a strategic one.

💡 You might find this helpful: Should You Invest in Dholera Smart City?

How GIFT City Impacts India’s Economy?

This isn’t just about shiny buildings. The goal of GIFT City is much larger, to bring back financial transactions that Indian companies currently do overseas. Every year, billions of dollars flow through Singapore or Dubai for things like:

- Overseas bond listings,

- Insurance reinsurance,

- Derivatives trading, and

- Offshore investments.

By localizing those operations, India can keep that business and those jobs within its borders. In simple terms, GIFT City helps India capture a bigger slice of the global financial pie. And beyond finance, it’s creating demand in construction, hospitality and education, fueling local economies.

The Road Ahead for GIFT City

Let’s be honest, building a global financial hub from scratch is no easy feat. Singapore had a head start of 50 years. Dubai leveraged its tax-free economy. India is trying to do both but within a democratic, regulated framework.

Still, the signs are promising:

- The International Financial Services Centres Authority (IFSCA) is steadily refining rules.

- More fintech startups are exploring GIFT City as their global base.

- And with global interest in India’s economy, the timing couldn’t be better.

Will GIFT City become the next Singapore? Maybe not overnight. But it’s certainly evolving into something uniquely Indian, a blend of policy ambition and practical growth.

FAQ

What is GIFT City and why is it important?

GIFT City (Gujarat International Finance Tec-City) is India’s first international financial hub located in Gandhinagar, Gujarat. It offers global investors and financial institutions tax benefits, regulatory flexibility, and world-class infrastructure.

Can NRIs invest in GIFT City properties?

Yes, NRIs can invest in both commercial and residential properties within GIFT City under relaxed FDI norms, making it a lucrative long-term option.

Is GIFT City a good real estate investment in 2025?

If you’re looking for long-term appreciation backed by government support, GIFT City offers promising potential — but it’s best viewed as a 7–10 year horizon investment.